Australian car market: car sales, statistics and figures

You might think that we would be second to none when it comes to car companies. With a population so small that each year more new cars are sold in China than there are people in our country, how important can Australia's car market share be?

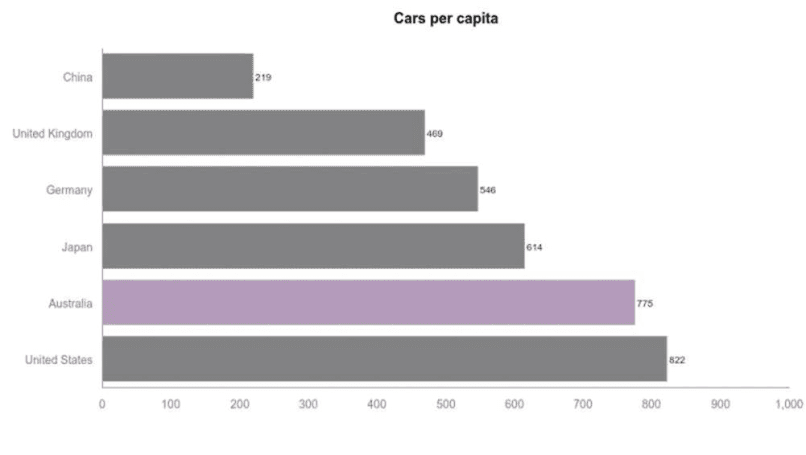

Taken as a raw number? Not good. But per capita? This is where the story gets interesting. This makes our car market a real global player. In fact, Australian new car sales figures are sometimes unbelievable. Yes, car sales in Australia have been in free fall for the last 18 months or so - and 2019 was a particularly terrible year - and yet even now we are well over our weight when it comes to cars sold per person.

How many cars are sold in Australia each year?

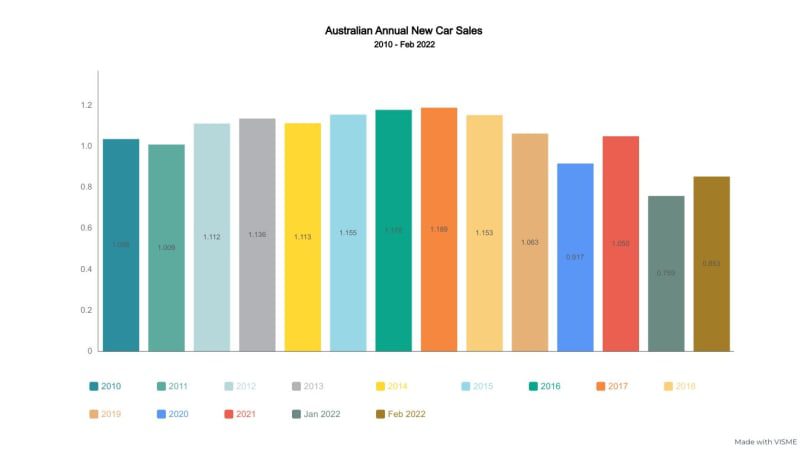

Need proof? Okay, let's look at this analysis; we have bought about 1.1 million vehicles every year for the past seven years. Even in 2019, when sales fell 7.8% to their lowest level since 2011, we STILL purchased 1,062,867 new vehicles.

Counting at home, Australian car sales were 2011 million in 1.008, followed by 1.112 million in 2012, 1.36 million in 2013 and 1.113 million in 2014. And they kept growing; According to official Australian car sales figures, Australian car sales in 2015, 2016, 2017, 2018 and 2019 were 1.155 million, 1.178 million, 1.189 million, 1.153 million and 1.062 million vehicles.

Overall, new car sales in Australia amount to over 8.0 million new cars in just seven years. In a country of 24 million people. This means that over 30 percent of our population has bought a brand new car in the same amount of time it takes to warrant a new Kia car.

Incredible, right? And even more so when you start to cross out people who don't actually drive (the elderly, children, etc.). No such data exists, I'm afraid, but you can easily imagine that this car sales statistic in Australia would rise to over 50 percent of the population with all non-drivers included. In fact, ABS data released in 2017 showed that there were 775 cars for every 1000 people in Australia.

And the 2019 Australian car sales data proved that our new car market, while slowing, remains roughly in line with our now-regular annual seven-figure record. But while it may look like business as usual, cut down on the raw numbers and reveal some worrying trends. First, in the 12 months to December 2019, our new car sales fell nearly eight percent. This in itself is not worrisome, except that 2018 numbers were lower than 2017 numbers, which were also down from 2016 numbers.

It shows a downward trend in the new car market that has been going on for several years. And many fear the worst is yet to come, as stagnant wage growth and an effective retail recession undermine consumer confidence.

best selling cars in australia

Again according to UBS data collected GoAvto, the number of premium or luxury cars sold has risen sharply since 2000 (by about 6.6% per year). In 2000, for example, premium and luxury cars accounted for 18% of the total market. In 2018, this figure was 35%.

But now those numbers are changing. While the mainstream market is mostly holding (well, it's fallen a bit), the former luxury darlings of the new car world have been hardest hit.

A breakdown of Australian car sales statistics by manufacturer shows that Audi sales are down 11.8% this year: Land Rover (down 23.1%), BMW (down 2.4%), Mercedes-Benz (down 13.1%), Lexus ( decrease by 0.2%. down XNUMX percent) everyone feels pain.

In fact, of the major premium brands, only Alfa Romeo is showing positive year-on-year growth, largely due to the small base expected from the newly launched brand.

The pain of these numbers has yet to be reflected across our top core brands, with nearly every one of them either holding their own or reporting year-on-year growth in Australia's crowded automotive market.

Car sales by brand in Australia

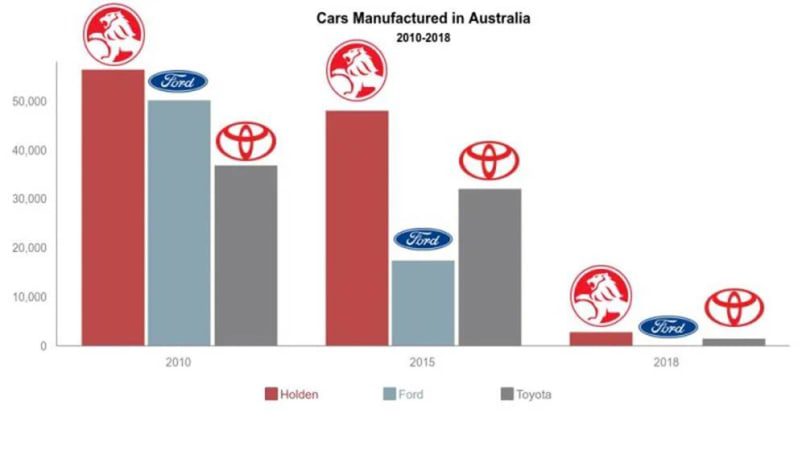

The list of Australian car brands that change the most units seems to have changed little since Moses got his L-plates (well, except for Holden and Ford). And 2018 was no exception: Toyota maintained its place at the top of the table with a total of 217,061 vehicle changes, up 0.2% from the 216,566 units sold in 2017.

Top 10 manufacturers by years 2014-2018

Top 10 manufacturers by years 2014-2018

Mazda is in second place with 111,280 vehicles sold compared to 116,349 sold in 2017 at 94,187. A similar story with the third-placed Hyundai from 97,013 2017 – almost close to the XNUMX sold in XNUMX.

Fourth place goes to Mitsubishi: this year the Japanese brand has sold a very good 84,944 vehicles, up 5.3%. Only Ford, in fifth place, recorded a drop in sales with 69,081 vehicles sold, down more than 11 units from last year, when 78,161 units were sold.

Now doesn't seem to be the best time for the former Australian car maker, with Holden in sixth place, continuing its terrible run of just 60,751 vehicle changes in 2018, down more than 32 percent from the same period last year.

But you only have to take a look at the top selling cars in Australia to see where the bulk of the growth lies. Of our top 10 2018 models, none were full-size sedans (unthinkable even a decade ago), but just three passenger cars. We have now entered the era of light commercial vehicles and SUVs. The car, if not dead, is dying.

The Toyota HiLux (a whopping 51,705 vehicles sold this year) and the Ford Ranger (42,144 vehicles sold) come in first and second. The Toyota Corolla and Mazda3 came in third and fourth in the sports competition, while the Hyundai i30 came in fifth.

The Mazda CX-5 came sixth and became the first SUV to make it into the top 10, followed by the Mitsubishi Triton, Toyota RAV4, Nissan X-Trail and Hyundai Tucson.

How many electric vehicles (EV) are sold in Australia each year

Short answer? Not so much. Although our market will soon be flooded with new electric models (including the Mercedes-Benz EQC and Audi e-tron), there are only a few brands on the market at the moment. The lion's share of sales is being gobbled up by the Tesla Model S and X (and 3, for short), but since the Silicon Valley brand is unwilling to publicly disclose local sales figures, we can't say exactly how many have found homes. in Australia.

In '48, only 2018 Renault Zoe vehicles were sold, and only two cars were sold in the first four months of 2019, while the Jaguar I-Pace EV SUV gained 47 buyers in the first four months of the year. Purely electric sales of the Hyundai Ioniq, which is available in hybrid, plug-in hybrid and electric vehicles, account for about 50% of that vehicle's total sales, and with the newly launched Kona Electric, the Korean brand's presence in the electric vehicle space will only grow. BMW, the first premium brand to offer an electric car, sold 115 i3 vehicles in 2018 and 27 sales in the first four months of this year.

But while the numbers make up a tiny fraction of the total market, the percentage is growing. According to official data from VFACTS, there were about 1336 electric vehicles sold in 2018 – public or private. However, this year, more than 900 electric vehicles were sold between January and April.

Used car sales statistics in Australia

The question is, does all this new car promotion affect the used car market? Is it suddenly flooded with almost new models as buyers rush to upgrade their wheels? Or sitting still?

It is difficult to decipher the exact answer to this. Surprisingly, ABS data released this January showed the average Australian car age at 10.1 years, a number that hasn't changed since 2015 despite the number of new cars sold.

In terms of how many used cars are sold in Australia each year? American automotive analysts Manheim found that our used car market is about three million units a year.